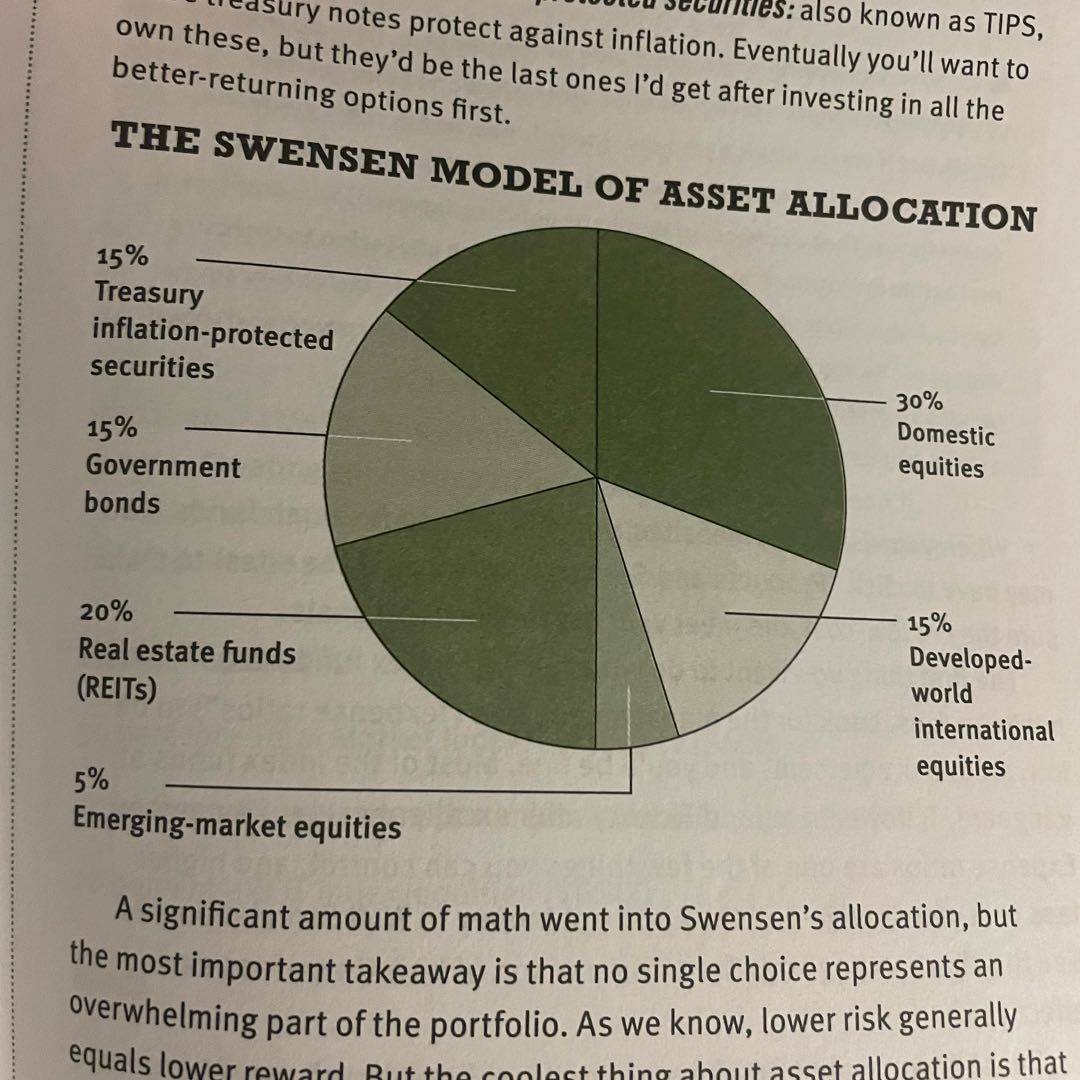

How to choose investments - or look for a target date fund with these percentage allocations

How to choose investments - or look for a target date fund with these percentage allocations

Buying a car:

- fightingchance.com is a good place to do research and

- should buy towards the end of the year when dealers need to meet quotas

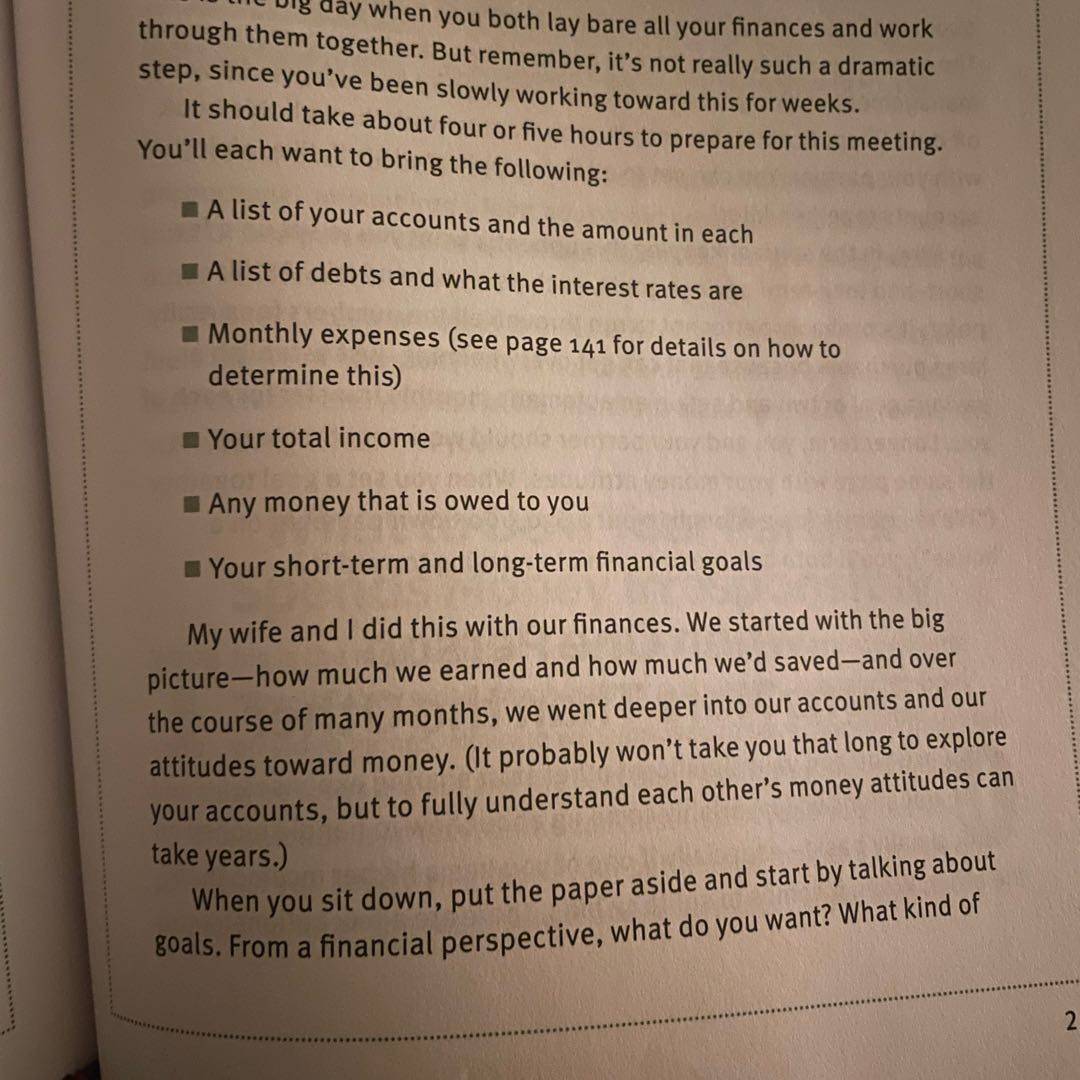

Agenda when you‘re ready to speak with your partner about $ specifics!

Recommendation: pay off student loans and invest approximately 50/50

You can remove your principal from your Roth IRA penalty-free.

“…if you‘re in debt, you should know how much you owe and the exact day your debt will be paid off. Almost nobody does” (53).

Tip: make large purchases on a credit card (instead of cash and debit cards) because CC offer excellent consumer protection

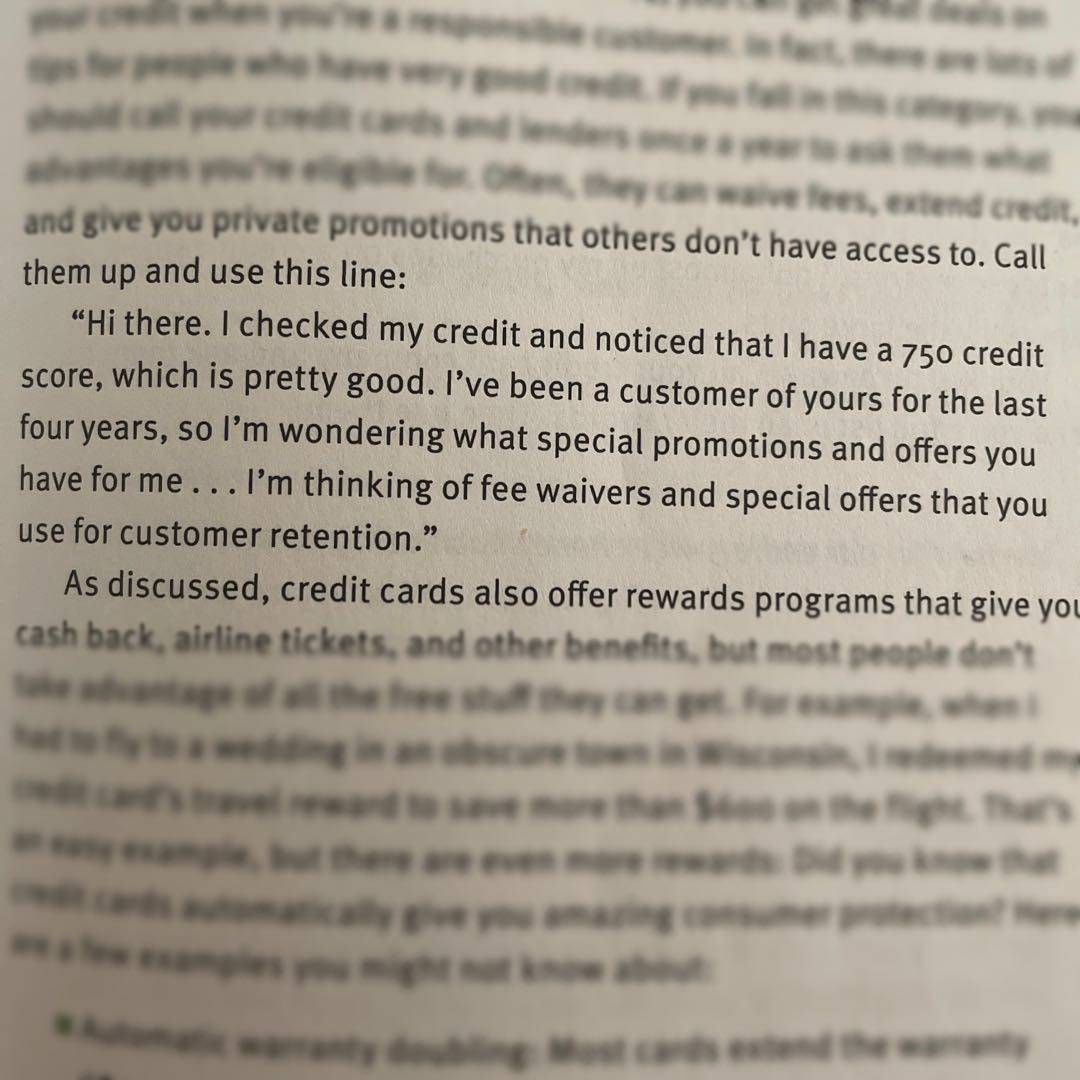

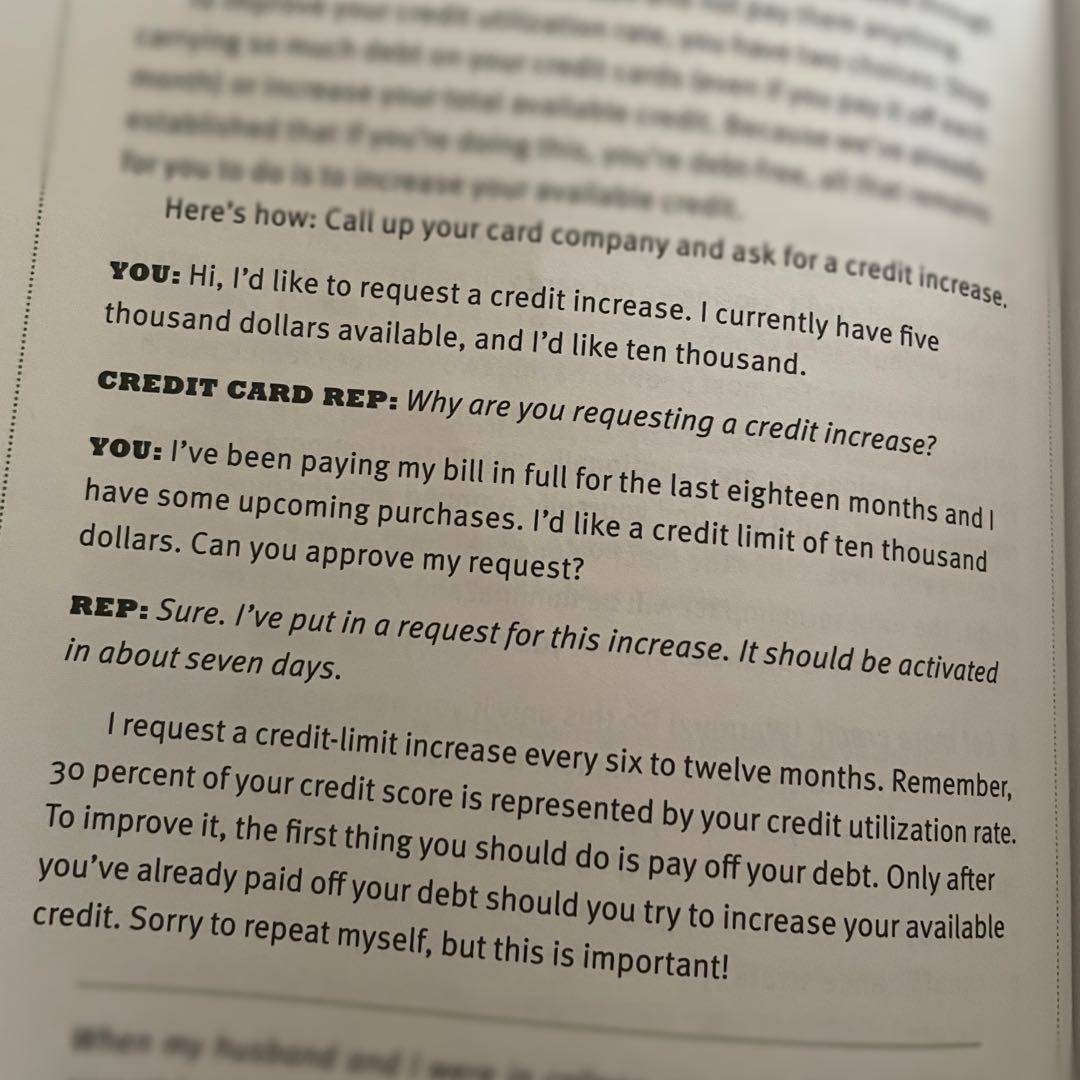

Tip: call CC companies once a year and ask this.

This tip is only for people who have no credit card debt and pay their cards in full every month.

Tip: if you‘re booking travel or eating out, use a travel card to maximize rewards (like Chase Sapphire Reserve). For everything else, use a cash back card (like Alliant).

Tip: open a credit card with excellent cash back rewards (~3%) to use to pay for a large expense

There‘s nothing surprising in this book & how helpful it is depends on where you are at in your financial planning. Personally, I got a couple of good ideas from this that made it worth the read for me. 💵💵💵💵

I made a page in my journal to devote to #pennyperpage. I am not sure if this format will work, but I had fun making it. If only I was as enthusiastic about not spending money! #bookjournal

Third book on my quest to learn more about personal finance. Written by an Indian, but about the American market mostly, still found it easy to relate to. Enjoyed that the writer seemed like he wanted to have a conversation with the reader than just impart wisdom blindly.

A good read for anyone new to this field.

Audio Review: Early on in the book I found Ramit extremely annoying and a lot of his jokes are terrible. It is good information though and it's worth ignoring his hot blonde twins comparisons to get the information. #goodadvice #financial

Here‘s yet another book I thought I may as well pick up today, thanks once again to Goodreads for the heads-up. 😉 It was actually only $1.20 on Kindle. #BookSale

I've been having money problems because I spend too much on books, booze, and food. So, I decided to buy another book to help me out! 😜

What my Eeyore shirt and I are reading! Don't let that face deceive you! I am actually really enjoying this book! I have never read a finance book before! I am glad this is my first one! I haven't finished yet, but I just had to talk about it!

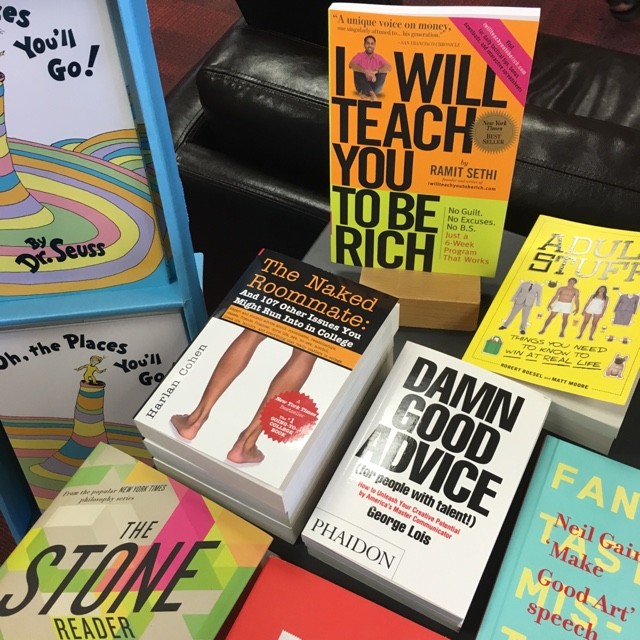

Forget "Oh the Places You'll Go" -- the college grad in your life (or the newly adulting 22-35 year old you) MUST read this book for no-nonsense, no-bullshit advice on getting your financial house in order. The breezy tone helps the POWERFUL MEDICINE go down. ???